Minnesota 2025 Tax Brackets. Informing, educating, saving money and time in minnesota us tax 2025. The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in minnesota.

The state’s highest rate, 9.85%,. These tables outline minnesota’s tax rates and brackets for tax year 2025.

Visit taxact to learn how to check status of your 2025 minnesota state tax return, including mn state tax brackets, personal exemptions, and.

Minnesota tax brackets, standard deduction and dependent, The 2025 state’s income tax brackets will change by 5.376 percent from tax year 2025. These changes will only impact the income minnesota taxpayers will earn in 2025 (due in april 2025).

Minnesota ranks 8th nationally for its reliance on taxes, Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660. This tool is designed for simplicity and ease of use, focusing solely on income.

2025 Tax Brackets Irs Chart Eula Ondrea, The federal income tax has seven tax rates in 2025: The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in minnesota.

Tax rates for the 2025 year of assessment Just One Lap, The minnesota tax calculator is updated for the 2025/25 tax year. Need help with your taxes?

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, Marginal tax rate 6.8% effective. The state’s highest rate, 9.85%,.

Federal Withholding Tables 2025 Federal Tax, 2, the following table provides the dollar amounts specified in minnesota statutes after adjusting for. Visit taxact to learn how to check status of your 2025 minnesota state tax return, including mn state tax brackets, personal exemptions, and.

Tax Rates 2025 To 2025 2025 Printable Calendar, 2, the following table provides the dollar amounts specified in minnesota statutes after adjusting for. Income tax rates for 2025 [+] these tables outline minnesota’s tax rates and brackets for tax year 2025.

Minnesotataxbracket » Estate CPA, Mn updated income tax brackets/standard deduction&dependent amounts for 2025. These changes will only impact the income minnesota taxpayers will earn in 2025 (due in april 2025).

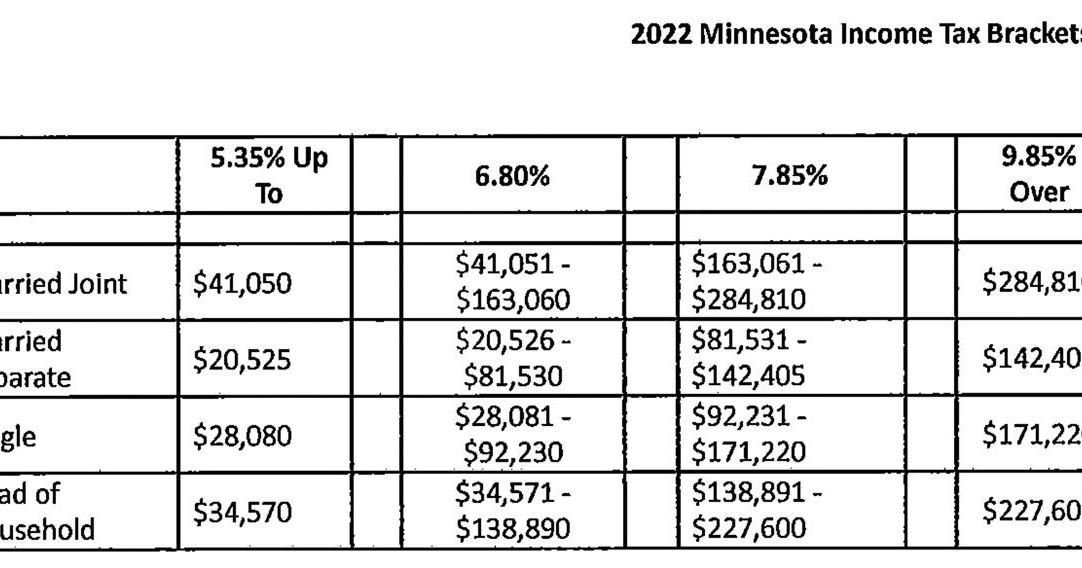

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, If you pay estimated taxes, use this information to plan and pay taxes beginning in april 2025. It features four brackets with rates from 5.35% to 9.85%.

Tax Brackets 2025 Individual Mela Stormi, The state’s highest rate, 9.85%,. If you make $35,000 in 2025 and win $100,000 in the lottery, your marginal tax rate jumps two tax brackets from 12% to 24%.

If you make $35,000 in 2025 and win $100,000 in the lottery, your marginal tax rate jumps two tax brackets from 12% to 24%.